what happens to irs debt after 10 years

Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. The IRS is supposed to automatically release any real estate liens it holds once the 10-year statute of limitations passes.

Internal Revenue Code section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

. A federal tax lien expires with your tax debt after 10 years. Once the bankruptcy court issues the discharge. This means the IRS should forgive tax debt after 10 years.

Can bankruptcy Stop IRS debt. By Timothy Hart December 19 2021 0 550. The collection statute expiration ends.

Get free competing quotes from the best. BBB Accredited A Rating - Free Consult. Generally speaking the Internal Revenue Service has a maximum of ten years to collect on unpaid taxes.

If you have received a 1099-C for a debt forgiven after the debts statute of limitation has run out 6 years in most states technically that money is not income. The IRS generally has 10 years to collect on a tax debt before it expires. The law requires the IRS to use private agencies to collect certain outstanding inactive tax debts.

Ad You Dont Have to Face the IRS Alone. However some crucial exceptions may apply. Talk to Trusted Tax Pro Now.

That means that your payment plan. Except for the automatic stay bankruptcy cases dont have much effect on tax debts that cant be discharged. Bankruptcy and the Automatic Stay Most IRS collections start with a notice of past.

If you have a tax debt with the IRS that is at least ten years old you might think that the agency doesnt have the ability to pursue you for. If it does not do so within 30 days you have the right. The short answer to this question is yes the IRS tax debt does expire after 10 years.

Unfiled taxes for the current tax year if the individual had income in the current tax year Unfiled taxes for the prior tax year if the individual had. Get the Help You Need from Top Tax Relief Companies. Resolve your tax issues permanently.

Find out for Free. Effective September 23 2021 when the IRS assigns your. And that can be both a good and bad thing.

Any actions that would have tolled the 10 years such as the filing of an offer in. In many cases as outlined below bankruptcy might end IRS harassment for good. Ad Do You ACTUALLY Qualify.

The good part of an IRS payment plan is that the IRS has 10 years to collect a tax debt from you. Its not exactly forgiveness but similar. 100 Money Back Guarantee.

Limitations can be suspended. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad Were here to help you resolve your Tax debt and get you back on Track.

The collection efforts the IRS pursues can only be in place for as long as your debt remains within the statute of limitations. As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. Ad End Your IRS Tax Problems.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Ad End Your IRS Tax Problems. If the 10 years has ended an IRS entry verifying your debt has been cleared to zero.

The day the tax debt expires is often referred to as the. Call now to Schedule a Free Consultation with an expert today. However there are a few things you should.

Ad Get free competing quotes from leading IRS tax relief experts. BBB Accredited A Rating - Free Consult. After that time has expired the obligation is entirely wiped clean and removed from a.

Tax debt owed to the IRS from prior years. Ad Honest Fast Help - A BBB Rated. Can the IRS Collect on a 10-Year-Old Tax Debt.

Defensetax Com Tax Guide Timeline 2014 Infographic Critical Dates Deadlines And Reminders Irs Taxes Tax Guide Tax Services

Pin By Safana On Mli Irs Taxes Its Time To Stop Tax Debt

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Tax Help Tax Debt Filing Taxes

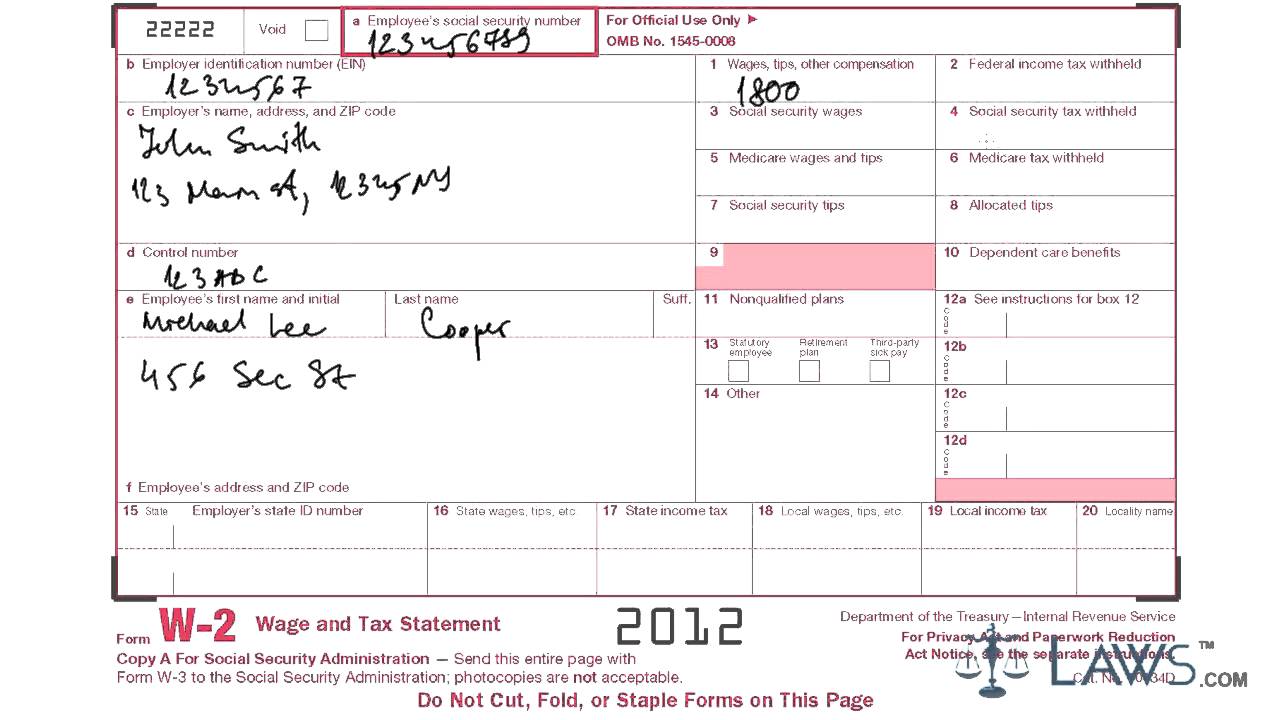

Learn How To Fill W 2 Tax Form

File Taxes Online E File Federal And State Returns 1040 Com

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Depe Tax Debt Debt Help Debt Reduction

Tax Tip Tuesday Knowing Whether To Spend This Year Or Next Year

Canceled Debt Is Considered Taxable Income Taxes Debt Paying Taxes How To Plan Debt

Payroll Tax Debt Relief How To Settle Tax Liability Tax Relief Center Payroll Taxes Tax Debt Debt Relief

Tax Refund Fraud Irs Crackdown Ensnares Legitimate Taxpayers

Irs Tax Debt Relief 9 Ways To Settle Your Tax Debts Tax Relief Center Tax Debt Relief Irs Taxes Debt Relief

Filing Prior Years Irstaxreturns Our Taxresolution Firms Believe That It Is In The Best Interest Of The Consumer To File A Irs Taxes Tax Debt Video Marketing

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help